I Want to Buy a Home

I Want to Refinance

What's the best loan for my situation?

Mortgage Calculators

-

Monthly Payment

This calculator computes the payments of principal and interest based upon a home price, down payment and other factors.

-

Refinance

Compare different mortgage terms and calculate your refinance savings.

-

Affordability

This calculator computes the finance amount, based upon income, expenses, credit rating and other factors to determine how much home can I afford.

The answers to all your mortgage questions...

Committed to giving you all the support and guidance you need to find the right mortgage options for you and your family.

About Us

Our Story

For more than ten years, Legacy MLC has provided industry-leading mortgage services and helped countless homebuyers and homeowners find financing solutions to meet their needs. Our reputation is based on building and maintaining relationships that last long after you get the keys to your home.

OUR STORY

OUR STORY

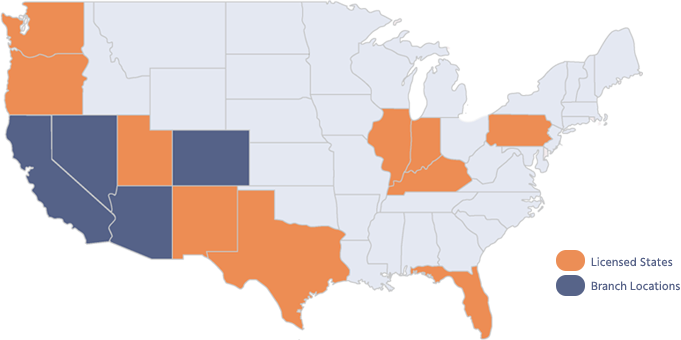

LOCATIONS SERVICED

LOCATIONS SERVICED

CAREERS

CAREERS